Enhancing Security with NFC Identity Verification and Liveness Checks

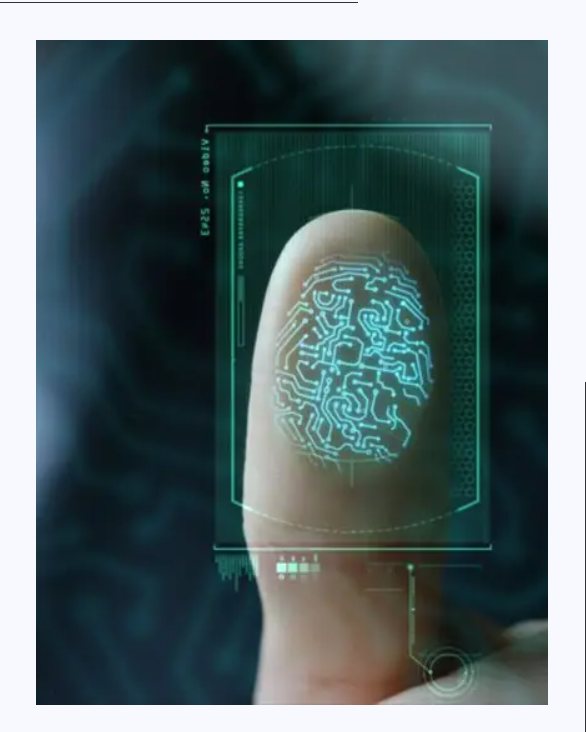

In the digital age, identity verification has become a critical aspect of online security. As fraudsters develop sophisticated techniques to bypass traditional authentication methods, businesses are turning to advanced technologies like NFC (Near Field Communication) identity verification and liveness checks to strengthen security measures. These solutions not only provide seamless user experiences but also significantly reduce identity fraud risks.

What is NFC Identity Verification?

NFC identity verification leverages near-field communication technology to authenticate an individual’s identity through an NFC-enabled device, such as a smartphone or tablet. This technology allows for secure reading of electronic chips embedded in government-issued identity documents, including passports, driver’s licenses, and national ID cards.

Unlike traditional methods that rely on manual data entry or optical character recognition (OCR), NFC verification ensures authenticity by extracting encrypted data directly from the chip. This makes it nearly impossible for fraudsters to manipulate or forge identity documents, ensuring a higher level of security and compliance with regulations such as KYC (Know Your Customer) and AML (Anti-Money Laundering).

Understanding Liveness Checks

Liveness checks are an essential part of biometric verification, preventing identity fraud by ensuring that the person undergoing verification is physically present and not using fake photos, videos, or deepfake technology. These checks use AI-driven facial recognition algorithms to detect natural facial movements like blinking, smiling, or head tilts.

By integrating liveness detection into identity verification processes, businesses can mitigate the risk of identity spoofing and unauthorized access, further enhancing cybersecurity measures.

The Combined Power of NFC and Liveness Detection

Integrating NFC identity verification with liveness checks offers a multi-layered security approach that is highly effective in preventing fraudulent activities. This combined solution works as follows:

-

NFC Verification – The user scans their NFC-enabled identity document using their smartphone, allowing the system to extract encrypted personal data securely.

-

Liveness Check – The user undergoes real-time facial recognition with liveness detection, ensuring they are a real person and not using spoofing methods.

-

Instant Authentication – The system cross-verifies the biometric data with the information extracted from the identity document, providing a highly accurate and secure verification process.

Why Businesses Should Implement These Technologies

Industries such as banking, fintech, travel, healthcare, and online gaming are rapidly adopting NFC identity verification and liveness checks to improve compliance, security, and user trust. These solutions help businesses prevent fraud, streamline onboarding processes, and enhance the customer experience.

- Business

- Art & Design

- Technology

- Marketing

- Fashion

- Wellness

- News

- Health & Fitness

- Food

- Giochi

- Sports

- Film

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- DIY & Crafts

- Theater

- Drinks